Designing Operational Risk Management (ORM) Framework (PowerPoint) Slideshow View

Operational Risk Management Best Practice Overview and Implementation online presentation

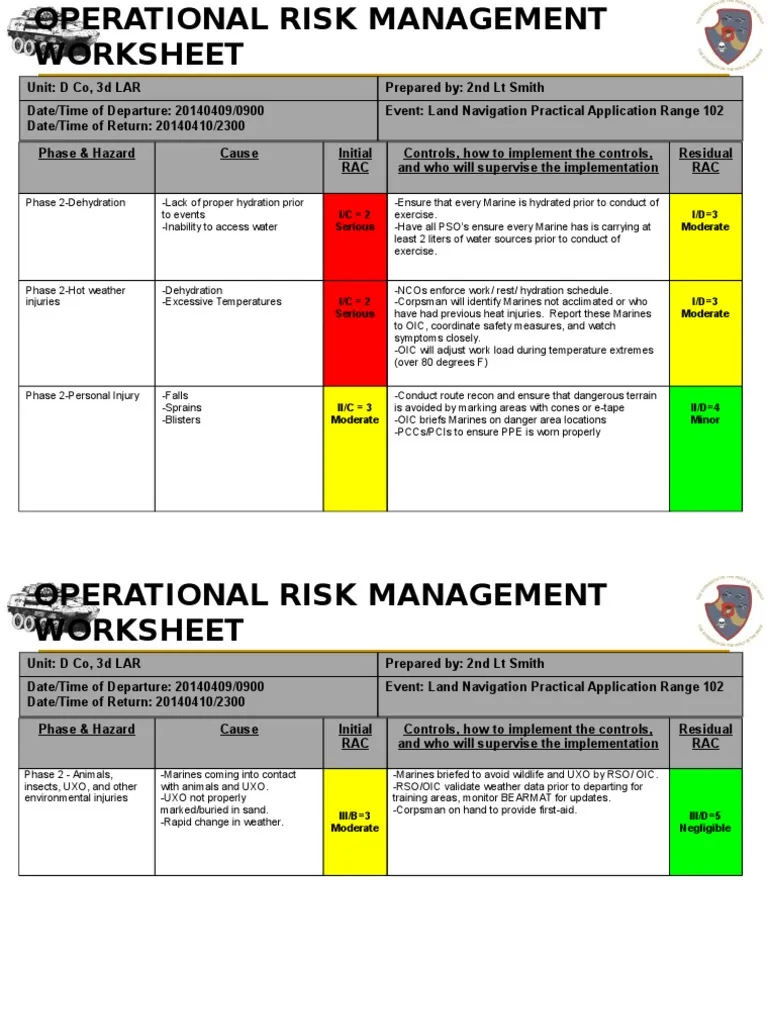

This step is where business managers identify, own, and manage operational risks and the controls that mitigate the identified risks. Risk identification should include triggers that institutions use to identify potential control failures that may result in operational losses.

Risk management B2Holding Annual report 2020

shifted to operational risk after greater initial focus on credit and market risk. An emerging regulatory focus—very much in line with sound day-to-day risk management—is to ensure that the . CCAR loss estimation framework be firmly grounded in the institution's regular operational risk management process.

Operational risk management framework. Download Scientific Diagram

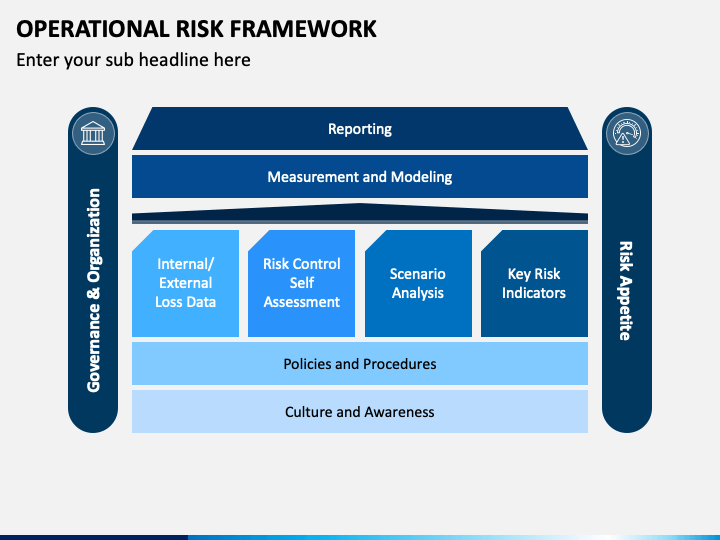

TheOperational Risk Management Framework is comprised of sevencritical elements and seeksto address regulatory expectationsby leveraging applicable KPMG methodologies related to enterprise risk management. A high level description of thesekey elements can be found below. Risk Strategy& Risk Appetite Risk Governance Risk Culture

Integrating Risk Assessment Into Lifecycle Management TraceSecurity

Transparency of controls. Framework for management process. Adherence to regulatory and legal requirements. Protection of Reputation. Positive influence on rating. Best practice implementation. Service Quality Improvement. Preservation of Capital.

Risk Management Framework And Why It Matters In Business FourWeekMBA

Operational Risk Management has increasingly become the most important of the three primary risks (along with Market and Credit Risk) facing corporations, and not just in financial services. Its key sub-disciplines - cyber security, business continuity, fraud (especially internal fraud), vendor management, and IT risks have assumed significant standalone proportions in recent years.

Operational Risk Framework PowerPoint Template PPT Slides

Here's a risk assessment framework template that covers all the stages of project procurement: Project Conceptualization, Project Planning, and Project Implementation. This PPT Template helps you review previous assessments and PRA (procurement risk assessment) of your company. perform internal and external analysis.

Operational Risk Management Template Risk Management Risk

Operational risk management Embedding operational risk management: The real use test Use test: the need for banks to demonstrate that risk management processes are truly integrated into the management of the business. The real use test: giving the business a risk framework that they can actually use.

The Risk Management Framework

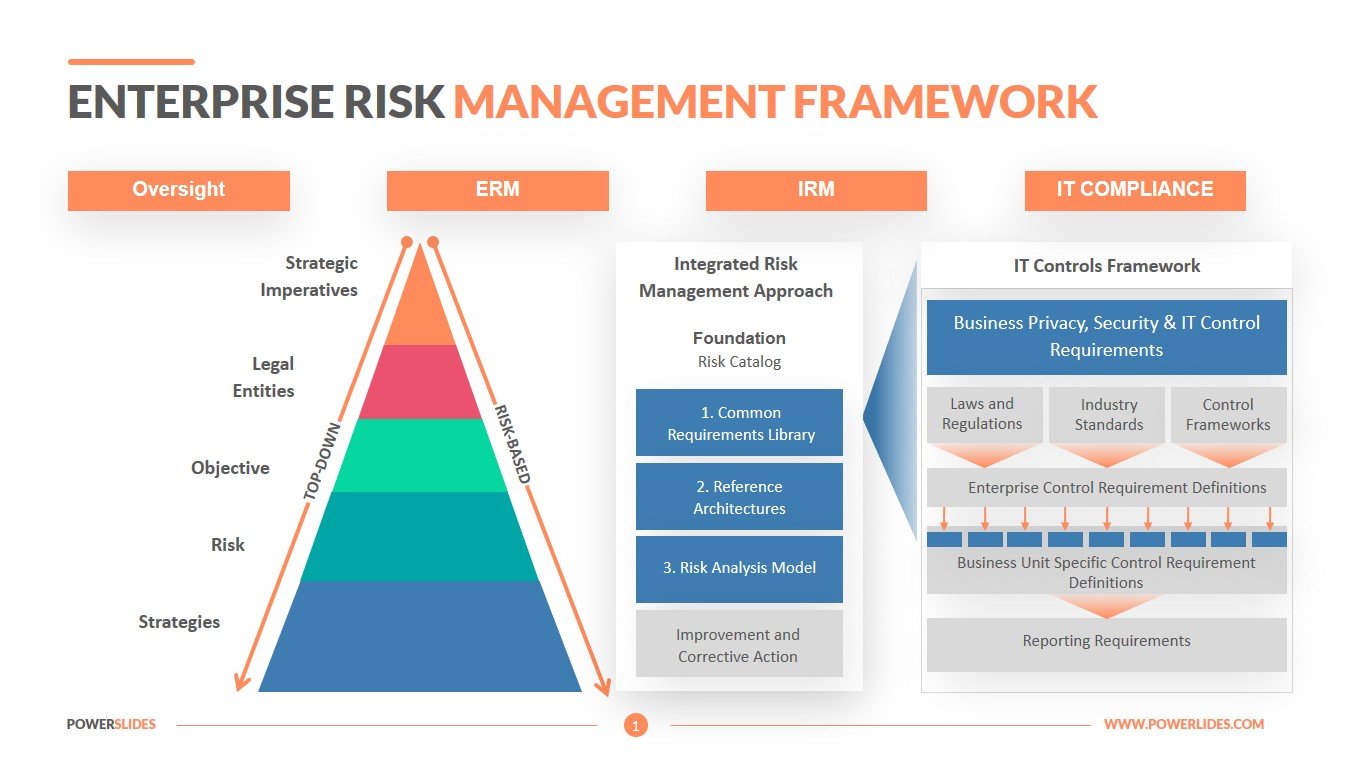

Operational Risks: This category contains operational risk, empowerment risk, IT risk, integrity risk, and business reporting risk. Strategic Risks: This category includes competition, customer risk, demographic and cultural risk, innovation risk, capital availability, regulation, and political risk.

Risk Management Definition, Strategies and Processes

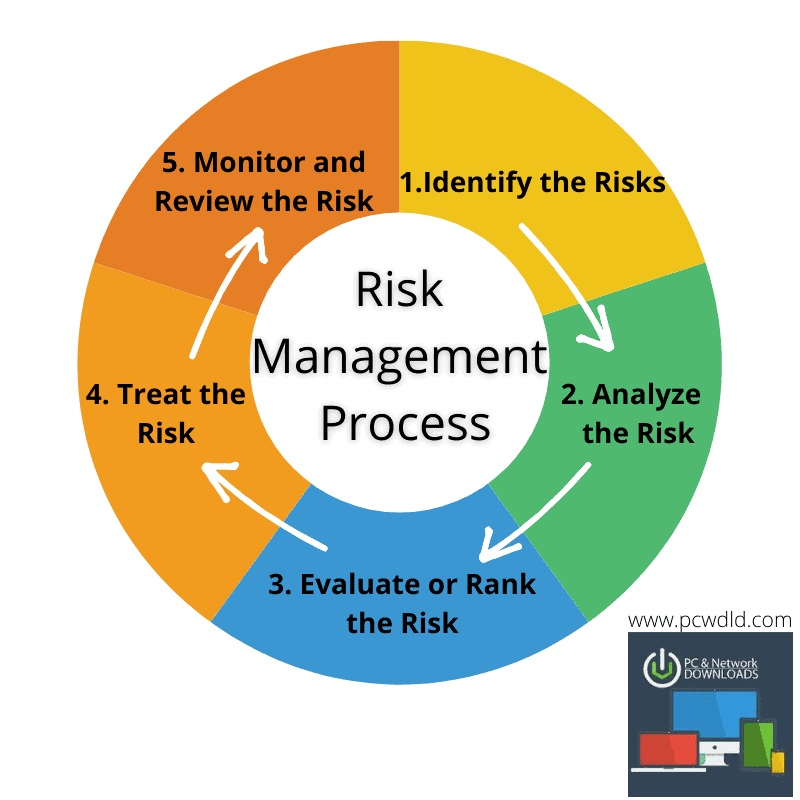

The goal of the operational risk management function is to focus on the risks with the most impact on the organization and to hold employees who manage operational risk accountable. Breach of private data resulting from cybersecurity attacks. Technology risks tied to automation, robotics, and artificial intelligence.

The Why and How of Integrated Risk Management

Project Risk Management Plan Template This template allows you to create a project risk management plan for Excel, which may be helpful for adding any numerical data or calculations. You include typical sections in the template, such as risk identification, analysis and monitoring, roles and responsibilities, and a risk register.

Enterprise Risk Management Framework Download Now

They represent a collection of operational risk management activities and processes, including the design and implementation of the FRFI's framework for operational risk management. The second line of defence Footnote 3 is best placed to provide specialized reviews related to the FRFI's operational risk management.

Risk management Failed Us! Explaining Security

This Operational Risk Management Framework is accomplished through a process that includes governance structure, operational risk identification, assessment, measurement methodologies, policies, procedures, and strategies for mitigating, controlling, monitoring, and reporting operational risks.

Nist Risk Management Framework Template Risk management, Risk analysis, Management infographic

SRM decisions are generally made at the Agency Administrator, Director Level or higher. Operational (Deliberate) Risk Management (ORM): Applies the process displayed in this guide and is completed when there is ample time. ORM relies on clear objectives, and each step should be documented.

Operational Risk Management in Banks

1. Operational Risk Management faa.gov Details File Format PDF Size: 103.4 KB Download Now 2. Reaping the Benefits of Operational Risk Management accenture.com Details File Format

Operational Risk Management Gets Smart with AI

Template 2: Operational Risk Management Framework in Financial Institutions PPT. Create an operational risk management framework that adheres to best industry practices. Use this PowerPoint Template to create consistent, transparent, and sound risk assessments for your company's operational details.

Designing Operational Risk Management (ORM) Framework (PowerPoint) Slideshow View

Our ORM framework can help you meet the challenge. Empowering informed business decisions The value proposition for strong operational risk management (ORM) is the effective management of operational risks that are inherent in the delivery of the business strategy.